flow-through entity tax form

The following are all pass-through entities. Is elected and levied on the Michigan portion of the.

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

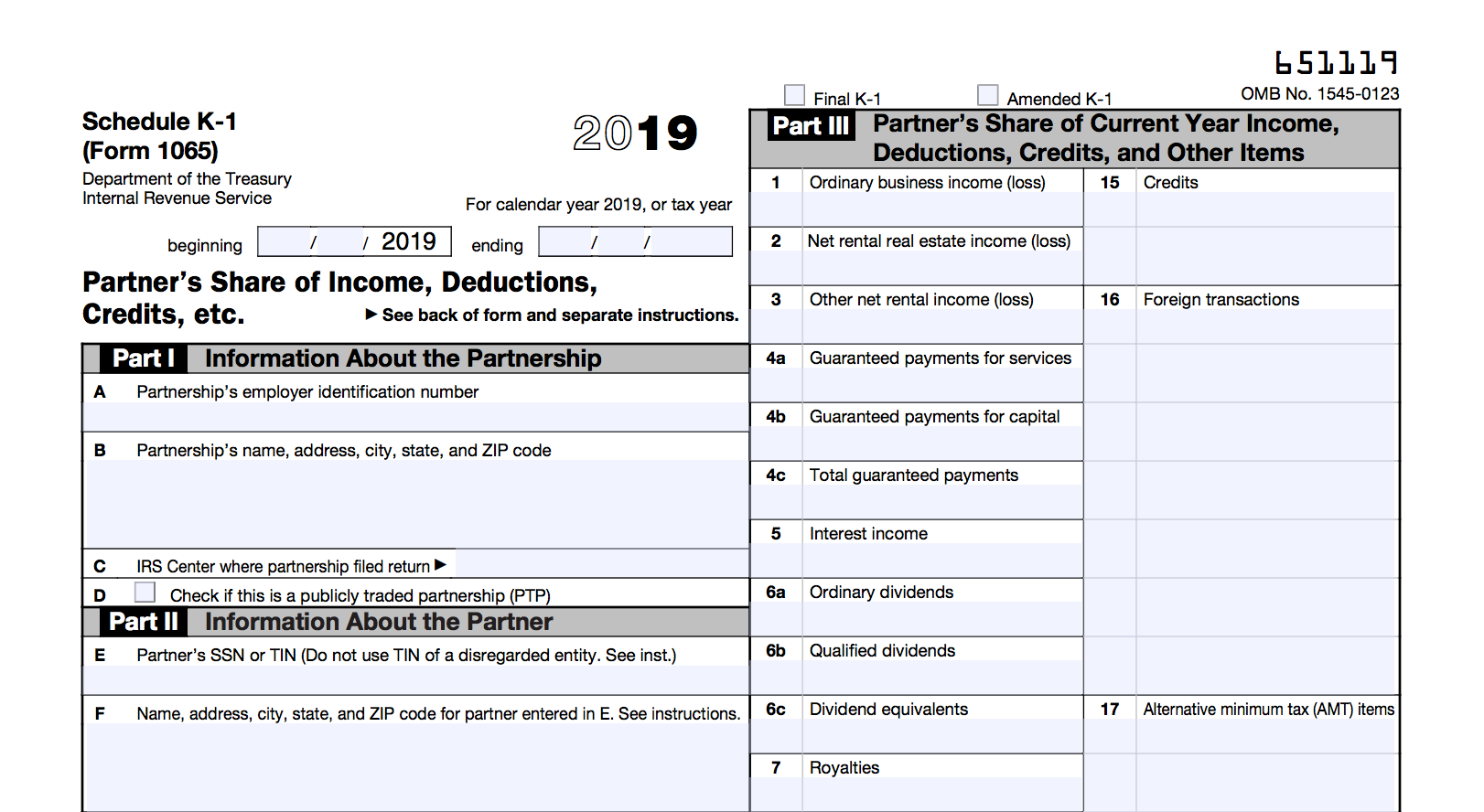

Schedule K 1 Beneficiary S Income Deductions Credits

AR1100PTV Pass-Through Entity Payment Voucher.

. AR1155 Pass-Through Entity Extension Request. Branches for United States Tax Withholding and. The Michigan Department of Treasury recently issued templates to assist taxpayers with filing their 2021 Michigan Flow-Through Entity FTE Tax Returns.

Advantages of a Flow-Through Entity. Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting Frequently Asked Questions Report and Pay FTE. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity.

Each entity calculates its 179 expenses and applies the limit. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Form 5773 Non-electing Flow-Through Entity Income.

2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session. Eligible entities can make the election for the 2022 New York State PTET through September 15 2022 using the Pass-Through Entity Tax Annual Election application. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

Governor Whitmer signed HB. This rule applies for purposes of NRA withholding and for Form 1099 reporting and backup withholding. One particular flow-through compliance concern is the existence of complex structures of related entities.

There are two major reasons why owners choose a flow-through entity. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan. This legislation was passed as a.

653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions. Income that is or is deemed to be effectively connected with the conduct of a. This guidance is expected to be published in early January 2022 and will be posted to the Departments website.

For calendar filers that date. For further questions please contact the Business Taxes Division. The entitys income only goes through a.

1 00 Schedule A Pass. The expenses subject to the limit are then passed. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain.

AR1100ES PET Pass-Through Entity Estimated Tax Vouchers. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. The deduction limits apply both to the business entity and the owner.

A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes. Flow-throughs are also a growing tax compliance concern. Entities must make an.

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Pin By Fm116 208 Fall2016 Group C On Fm116 Group C Paying Taxes Dividend Corporate

Pass Through Taxation What Small Business Owners Need To Know

Schedule K 1 Federal Tax Form What Is It And Who Is It For

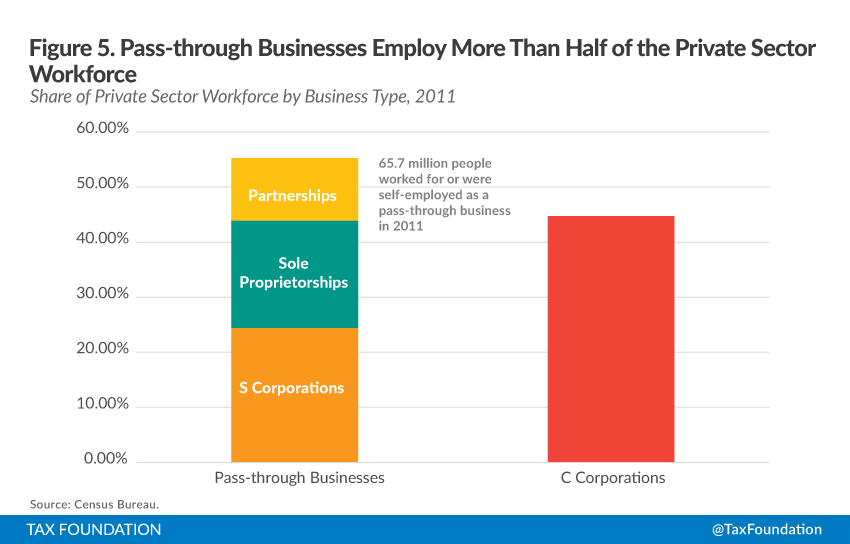

An Overview Of Pass Through Businesses In The United States Tax Foundation

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Pass Through Entity Definition Examples Advantages Disadvantages

An Overview Of Pass Through Businesses In The United States Tax Foundation

Complying With New Schedules K 2 And K 3

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Considerations For Filing Composite Tax Returns

Pass Through Entity Definition Examples Advantages Disadvantages

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition